Maximize Your Investment with Section 179: Unlock the Full Benefits of the Powers Running Assessment

As the end of the year approaches, many businesses and clinics are looking for ways to maximize their budgets while investing in the tools that can make a lasting impact on their operations. One of the best ways to do this is by taking advantage of Tax Code Section 179, which allows you to deduct the full purchase price of qualifying equipment. For those in the biomechanics, sports performance, and clinical rehabilitation fields, investing in cutting-edge tools like the Powers Running Assessment not only enhances performance analysis capabilities but can also provide significant tax benefits.

What Is Section 179?

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and software in the year of purchase, rather than depreciating the costs over several years. For 2024, the deduction limit is $1.22 million, with a total equipment spending cap of $3.05 million. This tax deduction is a huge incentive for businesses looking to invest in tools that can drive growth and improve operational efficiency.

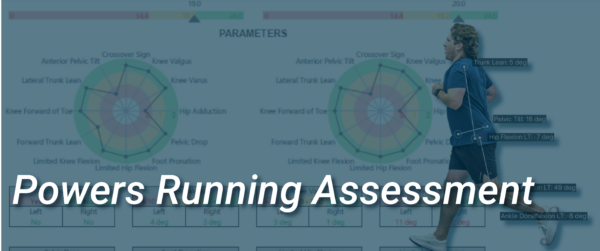

Why the Powers Running Assessment?

The Powers Running Assessment is a powerful tool for those looking to enhance their analysis of running performance, improve injury prevention protocols, and streamline rehabilitation processes. Whether you’re a clinic working with athletes or a sports facility offering elite-level training, this system delivers comprehensive running biomechanics data to support better decision-making.

Here’s how the Powers Running Assessment can help your organization:

- Accurate Biomechanical Data: Gain real-time insights into running mechanics, helping athletes and patients improve their technique and reduce the risk of injury.

- Customizable Reporting: Tailor the assessment and reporting tools to meet the specific needs of your clinic, research project, or sports program.

- Enhanced Client/Patient Outcomes: Use objective data to guide rehabilitation protocols, helping patients recover faster and with better outcomes.

How Section 179 Can Help You Invest

Purchasing the Powers Running Assessment before the end of the tax year allows you to fully deduct its cost from your taxable income, providing immediate tax savings and reducing the financial burden of investing in new technology. Depending on your tax bracket, this deduction could save up to $1.22 million, enabling you to reinvest in further growth or equipment upgrades. By taking advantage of Section 179, you realize financial benefits now rather than over time. Additionally, investing in cutting-edge technology positions your clinic or facility as a leader in human performance, enhancing client outcomes and attracting new clientele.

Act Now: Before the End of the Year!

The Section 179 tax deduction is a limited-time opportunity that resets each year. To take advantage of this powerful tax benefit and invest in the Powers Running Assessment, you must make your purchase before the end of the tax year. By acting now, your clinic, research institution, or sports facility can position itself for success in the coming year, both financially and operationally.

Ready to invest? Contact us today to learn more about how the Powers Running Assessment can enhance your performance analysis capabilities while helping you save through Section 179.